Allowance For Mileage 2024 – “Mileage allowance” is a term the Internal Revenue Service (IRS) uses to refer to the deductibility of expenses car owners accrue while operating a personal vehicle for business . It involves a monthly allowance, which is a set payment given to employees, as well as mileage reimbursement payments, which are based on the employee’s actual monthly mileage. The goal is to make .

Allowance For Mileage 2024

Source : www.everlance.comCanada 2024 Mileage Rates, Automobile Deduction Limits | Cardata

Source : cardata.coThe 2024 IRS Mileage Rates | MileIQ

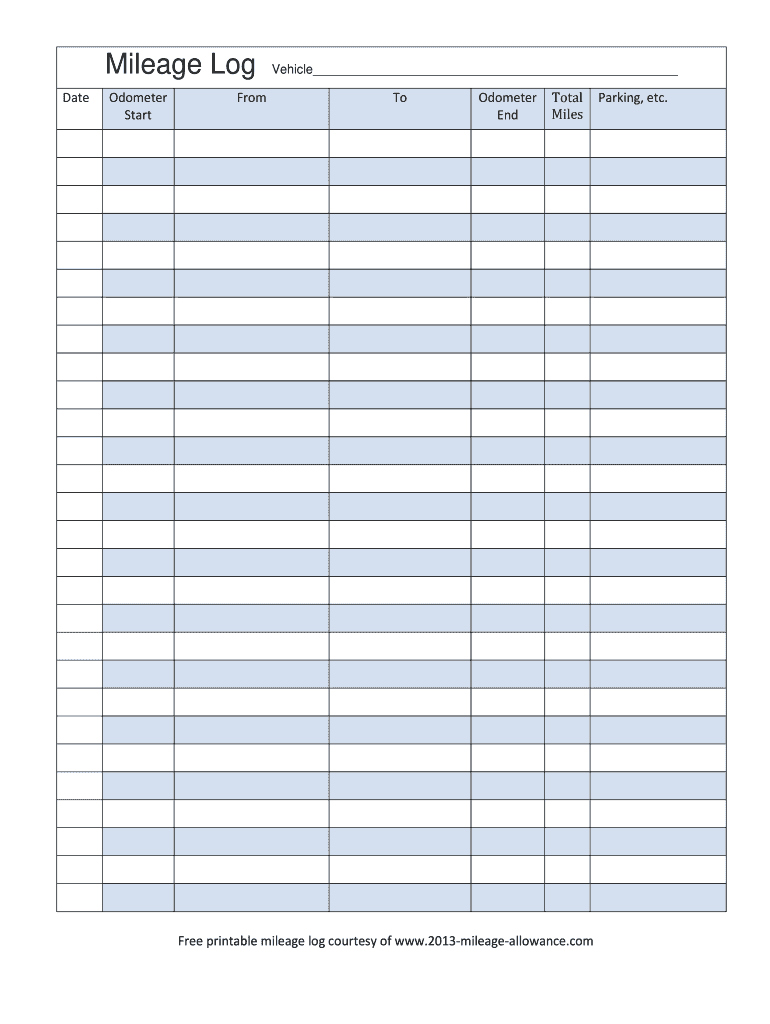

Source : mileiq.com2013 2024 Form Mileage Allowance Free Printable Mileage Log Fill

Source : mileage-log-printable.pdffiller.comTimeero IRS Mileage Rate for 2024: What Can Businesses Expect

Source : timeero.comExpense Management News And Insights | Mobilexpense Blog | Compliance

Source : www.mobilexpense.comIRS Mileage Rates 2024: What Drivers Need to Know

Source : www.everlance.comMileage Reimbursement in Europe

Source : www.eurodev.comCRA Mileage Rate | Canada Automobile Allowance Rate

Source : www.everlance.comPennsylvania Mileage Reimbursement Explained (2024) | TripLog

Source : triplogmileage.comAllowance For Mileage 2024 IRS Mileage Rates 2024: What Drivers Need to Know: Following complaints from veterans and a critical VA Office of Inspector General report on the VA’s travel system, the department is streamlining ways for veterans to submit travel claims. . Among the chances for honest graft which come a legislator’s way, few are more hallowed by time and custom than mileage allowances. U. S. Congressmen get 20¢ per mile for traveling between their homes .

]]>.png)