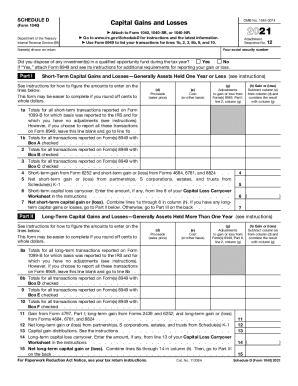

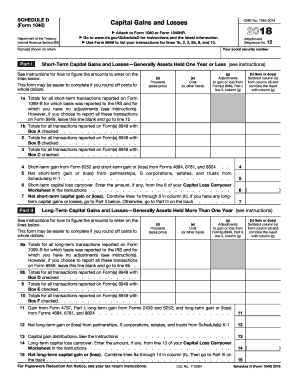

Irs Schedule D Tax Worksheet 2024 – The deadline typically falls on April 15. Meeting tax deadlines is crucial to staying compliant with IRS regulations and avoiding penalties. For individuals filing taxes on a calendar year basis, the . Congress is working on expanding the child tax credit for tax years 2023 through 2025. Now that we’re in the middle of tax season, you may be wondering whether it’s best to hold off on filing your tax .

Irs Schedule D Tax Worksheet 2024

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govForm 1040: U.S. Individual Tax Return Definition, Types, and Use

Source : www.investopedia.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comNew IRS Schedule D Tax Form Instructions and Printable Forms for

Source : kdvr.comIRS Schedule D (1040 form) | pdfFiller

Source : www.pdffiller.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comIrs Schedule D Tax Worksheet 2024 When Is Schedule D (Form 1040) Required?: Capital gains are the profit you make when you sell a capital asset (such as real estate, furniture, precious metals, vehicles, collectibles or major equipment) for more money than it cost you. . (CBS DETROIT) – Michigan’s individual income tax rate will rise in 2024, increasing from 4.05% back to 4.25%. In 2015, the Michigan legislature passed a law that required a temporary reduction of the .

]]>:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-834ca4d0e21d479e90109c049215ae43.png)

:max_bytes(150000):strip_icc()/Screenshot2023-12-15at12.57.18PM-4df7a66986cf4a1ab5cc962b78b698fd.png)